France’s Digital Tax – level 2

13-12-2019 07:00

France and the US met to discuss large tech companies that do business on the Internet. The problem is how to tax the companies because France wants to tax them.

The US says that it can tax some of them because many of them are US companies.

France says that these tech companies use global tax rules to move the profits to countries with lower taxes. Then they avoid paying higher taxes in the countries where they do business.

In the summer, France passed a digital tax on tech companies that make money in France. Three other countries also passed similar taxes. However, an intergovernmental organization is working on tax proposals for tech companies, and it wants to create a worldwide solution that is fair for everyone.

Difficult words: profit (money that you make when you do something), intergovernmental (when many countries’ governments work together), proposal (a plan, an offer).

You can watch the original video in the Level 3 section.

What do you think about this news?

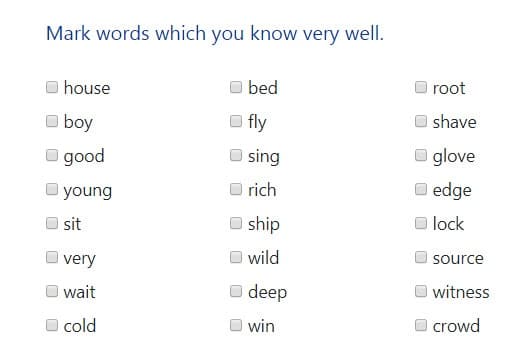

LEARN 3000 WORDS with NEWS IN LEVELS

News in Levels is designed to teach you 3000 words in English. Please follow the instructions

below.

How to improve your English with News in Levels:

Test

- Do the test at Test Languages.

- Go to your level. Go to Level 1 if you know 1-1000 words. Go to Level 2 if you know 1000-2000 words. Go to Level 3 if you know 2000-3000 words.

Reading

- Read two news articles every day.

- Read the news articles from the day before and check if you remember all new words.

Listening

- Listen to the news from today and read the text at the same time.

- Listen to the news from today without reading the text.

Writing

- Answer the question under today’s news and write the answer in the comments.

Speaking

- Choose one person from the Skype section.

- Talk with this person. You can answer questions from Speak in Levels.

Stock images by Depositphotos